First a little context and my clickbait "THE ONE CHART THAT SCARES ME"

This is 1yr rolling % change for UVXY going back to ~1yr after inception (so we can have 1yr rolling data points)

What scares me is that little tip there in 2018, meaning for the 1st time in this product, the 1 year rolling decay couldn't offset a vol spike (which is pretty significant given the average decay is ~80%). The main factor here is the deleverage of the ETF from 2x to 1.5x, while the same time period had the Feb 5 2018 vixtermination. Its hard to split up how much of each factor contributed to this chart, and if they are multiplicative. (leveraged on the VIX spike, and deleveraged on the way down)

A future vol spike will have the benefit of equal leverage on the way up and down, although that will cause the product to more closely resemble VXX 1 year rolling.

Because of the uncertainty around this, as well as the possibility of mid spike leverage changes by the funds, I still don't think we can have a constant 1yr+ duration rolling short UVXY position, so I want to wait for some amount of spike before re adding the position.

With that context, what am I doing now?

Given the mid/low VIX range at ~12/13 and SPX IVR at 0-10 this last month, I have been very active with short term calendars (~7dte/21dte) to keep a low delta/positive vega and long theta position on while waiting for a big vol move. I've specifically been trying to take them off at 5-10% profit or at a loss when theta goes negative.

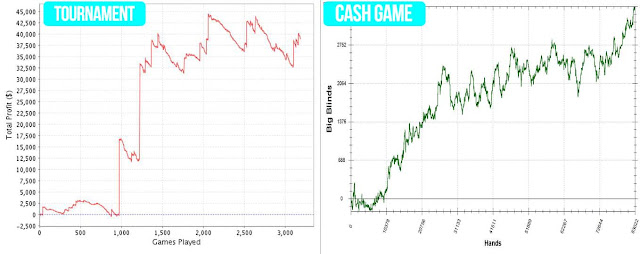

And here is my poker metaphor for these trades-

2 types of "I've got you"...1. I have the nuts, just salivating to see what you will bet, or if I can get a check raise. The sense of skill is from how much can I win in this hand- trapping, etc

2. I am defending... I know from the opponents betting pattern/ranges that they probably have the nuts/ top of their range and they are salivating to see how much they can get from me. The real skill/strategy is from seeing if I can get a free card in this hand, do everything to not get trapped and lose the minimum. When they finally bet and you insta-fold, you both know that even though you 'lost' the hand, you got them. As the defender you more correctly assessed both hands and took their big spot that would normally be a big % of their winning session.

With these short term, at the money SPX calendars I'm specifically trying to get small wins and losses, just flip the weighted coin as much as I can. If you are primarily used to short options/ spreads and rolling the other side/ rolling for duration, it might be harder to mentally click over to at the money delta/theta adjustments to be most capital efficient. Ultimately I'm trying to be conscious of that 2nd bulletpoint of poker which gets lost in the 'win the maximum' $TSLA meltup we have been in.