There are two broad trajectories that poker, options, and many other business models take; the slow grind up with big down spikes, and the occasional huge spike up with a mostly dwindling trajectory otherwise.

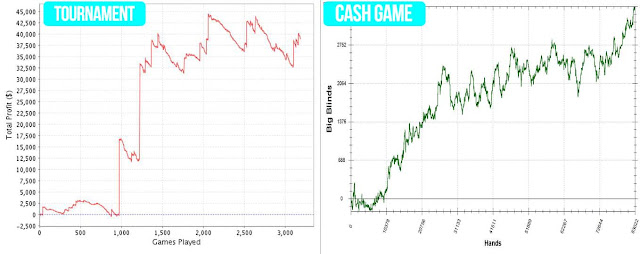

Here is a rough picture I've seen, with the left showing a tournament poker trajectory. The straight vertical line jumps are huge tournament finishes winning 10-20x of the buy in. The rest of the time is slowly losing buy ins. (with minimum cash payouts here and there, but I'm trying to simplify)

The right shows a cash game trajectory with a slower grind up and occasional big down moves or losing streaks, this is when multiple all-in preflop hands go awry, for example. (The James Bond hands of straight flush over full house over full house)

What does this have to do with options? I think these two different trajectories represent the two psychologies of long vs short options. (And of course as you get more sophisticated you might mix in a lot of long/short option combo strategies, but lets just call this net long vs net short)

The tournament poker chart on the left represents the appeal of long options, paying a small premium (tourney entry) and hoping for a 2 standard deviation move. You will slowly lose buy ins and get an occasional huge score. This is the basis of a lot of the entry options content which explain the huge leverage you get and post huge percentage gains while ignoring the losses.

In contrast, the right cash game chart represents the change to selling options, taking in the premium slowly over time, and having huge outlier moves occasionally hurt you.

In terms of looking at this like a business, what looks better? I would argue (along with poker players and premium sellers) that the right chart is what you are looking for to better predict returns, smooth out your equity curve, and create overall consistency. This doesn't mean we will necessarily always over perform or even win, but it is about the psychology of having a strategic system with a smoother curve. Personally, I don't want to have to be waiting for a big upward spike in my profit curve just to be on track.

Would you rather have to require or need to avoid outlier moves in order to win over time?

Would you rather need to hit a flush on the river, or have the made hand and need to dodge a flush?

Even the best tournament poker players have all made the bulk of their money from cash games!

One final note on Tourney/cash poker vs options, I would say almost everything in poker translates directly to options, one of the exceptions comes up here in tourney vs cash for bankroll management, or "account size" in options land. Generally you need a larger bankroll for tournaments because of theoretical outlier moves of not cashing many events in a row. This contrasts being long options which have defined risk, so the theoretical account requirement is much lower. Its a good thing to keep in mind how account size/bankroll management fit into all aspects of your life and the different risk profiles of things you do.

No comments:

Post a Comment