Well we did it, another blowup in the vein of 2/5/18 (not in notional value, but in the conceptual "well what was that?" aesthetic)

For Vixtermination I specifically made a flowchart:

Where long SVXY right at that exact moment was the only real way to get popped in the long duration short VIX system.

Again, we have a similar setup of "Trump impeached vs trump in office" vs similar trades where the outcome is the same (dismissed in the Senate) but one exact trade blows up.

Well I fucked this one up again- I truly couldn't foresee them going this far on 0 evidence, running back the 3rd or 4th impeachment vote of the year and finally tipping the vending machine over. And for all the distressed liberals "HE REALLY SHOULD BE IMPEACHED AND DESTROYED" - there are infinite legitimate articles ie. executive order ban on bump stocks, executive order on hate speech-

He was sworn in on the oath to uphold and protect the constitution, and is making literal executive orders against the 1st and 2nd amendment - which no one is disputing/ hiding/obfuscating. Yet they went forward with the most vague impeachment articles that were thrown out by every legal scholar.

I'm getting back to short VIX as this ties into my broader market/elephant metaphor-

All these actions are interlinked with fake trade deals/ tax rate policy and thus liquidity.

If the closest actions thus far to removing Trump (the tax cuts/ 'we need lower rates/ bigger bubbles') president and trying to force in a Warren/Bernie 'we need to blow up wall street' candidate is good for SPY all time high, then what is the point? Its 100% liquidity (Fed 500b by Jan)

Is this what the permabears sound like? "there is no real market, no actual price discovery:

Is there no real government? If 1 party controlled house and senate, then what stops this process going to completion and invalidating the executive branch?

I guess I'm a little tense as my short VIX deltas have dwindled this year so I guess I'm not full capitalizing on the elephant path we are on. Even going into the year with the core thesis that nothing happens, its getting a little fucked even for me.

So do we just throw it all to the wind and go 100% all in SPY and just give it up? There is no political mechanism to stop the Fed pump so why even try to flatten deltas. This is not coming from a permabear that is all in short- I'm just trying to hit that theta and see if we can even stay inside a 1-2 std dev rip, not a vertical line rip.

My only concern is when the vertical line capitulation kicks in and the max short pain points get hit is when we get the reversal, but again its only temporary until the Fed can re pump. The most maddening thing about this though, is any "all in SPY" boglehead can't even articulate 1% of these back end processes that are key to their thesis, they just point to a straight vertical chart.

I'm still not quite there, I'll still be trudging through on the low delta, maxing theta plan. Who knows, maybe we might get a single year this decade inside 1 std dev.

Please tweet me, refute any of this...

Thursday, December 19, 2019

Friday, November 22, 2019

The market "elephant" metaphor

I've had this stewing for a while, and it once again came to a head when I got in a twitter argument culminating in "real capitalism has never been tried"

I run into these conversations a lot, either viewing or participating, ultimately dealing with "real socialism/capitalism/ X" has never been tried, addressing something as a fiscal/monetary policy ONLY, or some other type of "no true scotsman" argument when related to markets/economics.

The biggest recurring frustrations I see, specifically in market/econ/trading podcasts (and tell me if this sounds familiar):

- "I want to talk about SPX catalysts/ trades coming up this week, WITHOUT BEING POLITICAL"

- "I don't want to get into the Fed POLITICALLY, but lets discuss the fomc bulletpoints"

- "Without talking about the POLITICS of MMT, lets look at this gold chart..."

Thus comes the Elephant metaphor-

I see a world of people specifically setting out to put on the blindfold:

- Looking at valuation fundamentals without acknowledging the global liquidity/monetary regime

- Talking about pure political power/influence and not the real dollar amounts/paper trail flows behind it.

- Never following incentives all the way up the chain in any policy/financial structure.

So when we talk about liquidity, those are the tusks, "fundamentals" are legs, political influence on these markets are ears...

I just don't have a name for the whole elephant... the system? I don't think that reflects the specificity I'm trying to get at.

In the meantime just remember when you see an article on any of these bulletpoints, it is not looking at the whole. Any micro-level inefficiency is explained by at the macro level.

Until then, we are dealing with the whole elephant...

Monday, September 23, 2019

A Nat Gas/ wheel trade Odyssey

I thought I would share a little trade example of my "premium over everything" life philosophy: a nat gas trade which started out as a short put after it got crushed from the huge late 2018 rip which notably wiped out Optionsellers.com --->

I thought I would share a little trade example of my "premium over everything" life philosophy: a nat gas trade which started out as a short put after it got crushed from the huge late 2018 rip which notably wiped out Optionsellers.com --->"It was a rogue wave.... I wake up every morning trying to steer the ship..."

That was a case study in itself, where he liquidated all client funds before spot was even at or near his short call strike prices.

Back to $UNG... anyway after that rip and drop, here you see spot around ~$22 which was a multi year low/ semi support if you believe in that, and where I got in with the first short put .. the 21.5p for 33c , which was my target range of 15%+ annualized premium, and an additional ~4% downside to breakeven, already at extreme lows.

While this is an actual underlying/commodity, this is going in with the short VIX mindset/ short premium at least.

Well it turned ugly quickly!

Over the next ~month we went from $22 to $18.50, a nice ~20% bloodbath..

And here is where a live example of the clenched wheel strategy comes in. Again, for trades like this always leg in, giving the option to lower your basis as it murders you like the above. The green lines are the short puts, from the trade date spot to the option expiration date and strike.

I was assigned several tranches from 21.5 down to 19, getting the average cost around $20 by July

Once I've averaged down til the July range, you see the orange lines for short calls, to start lowering the basis on my assigned stock position. (some of these were 1 lots, some bigger, I just wanted to give the feel of trajectories)

The final rightmost short calls you can see targeting my avg assigned stock price which was only 19.50/ $20, meaning the last big rip up was unnecessary for breakeven, but a welcome kick in the face from the fates nonetheless.

All in all, a grueling ~1% profit over 4 months on a 20% bloodbath underlying...

The most important thing being I didn't need the last rip, every trade is centered around the assumption in no move for you in the underlying.

This applies to $UVXY short call spreads/condors, very close ATM covered calls on dividend underlyings, or ITM covered calls.

LIFE NEVER GOES MY WAY, so trade like it! Maybe this philosophy isn't for everyone, but it works for my mix of nihilism, fatalism, solipsism, simulation theory-ism, and if you believe in "late cycle."

I hope this was worth it for at least one of you! I'm trying to be the change I wish to see in the world- post bad trades, many adjustments, perseverance! 99% of financial interviews are just ignoring the guest's last missed prediction and moving on... That isn't real life! The wheel trade is the grueling metaphor for the actual grind.

Saturday, August 10, 2019

The Epstein Vol Crush

THIS IS EVERYTHING I AM TALKING ABOUT

The Short VIX of non market events, we have an upcoming tail risk/volatility and just like that - faded and forgotten. Please bookmark and come back in 1, 3 , or 6 months and I hope it expands your view of how close market short vol compares to LIFE short vol.

Two components:

FADED-

The immediate vol spike: For this week, "EPSTEIN ""APPARENT"" """SUICIDE""" "-

Oh no, everything is unraveling, our system is on the brink of collapse! I can't believe this can be happening in 20xx!

12 hours later: Wow wasn't that news crazy? Look at these great memes people made about it! But seriously this is crazy!

1 week later: WE NEED TO MAKE GUNS ILLEGAL! Jeff who?

Does this sound familiar? because the last Epstein vol spike was "global pedo elite sex ring, its all unraveling! Drone footage of the island" , and the 24hr news cycle washes it away on the next weekly shooting/ political gaffe etc.

(Just the continuous front month /VX chart for this year but useful to visualize the news cycle hype of non-market VIX events)

FORGOTTEN-

The much longer term trend of the biggest political scandals and events which are out of the public eye due to the 24hr news chop- much like the up and down chop of leveraged $UVXY lends to its long term massive decay- 100 + 10%, then -10% = 99

On a macro level, the recent "suicide" is just part of the previous cycle's faded-> forgotten, namely another branch of potential evidence into the last few decades of the Clinton dynasty is clipped, now to be filed for the future as conspiracy just like Northwoods, Paperclip, Tonkin, etc. Additionally, this decade all data is centralized, digital and hashtagged, (for ease of search, but for $GOOG ease of search and destroy)

So what is there to do while our world crumbles in indifference? I didn't come to you without hope, as there is a trade here!:

As I wrote earlier this year, on the "safe" tranche of fading political risk trades (No Trump impeachment, no Hillary, Huma, Don Jr, Kushner charges), all signs point to the continued decay of this market, almost exactly like a short VIX option position.Furthermore, news like today only emboldens my thesis that these kind of tail risks for corrupt figures to go down is gated by so many different layers of defense inside legal, illegal, and market systems that the prediction markets are still mispriced.

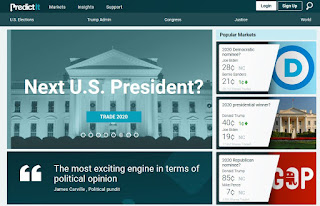

Unfortunately Predictit didnt have an Epstein suicide market directly, but what a proxy the Clinton market is!

Monday, July 22, 2019

"The next one will do it"

"Why does the US spend more on military than every other country? We could solve world hunger or health care"

You may have run into this discussion personally, or seen it ad nauseum on political shows, debates, etc

To that I would say "Ok, which country do you want to have the highest military spending: US, China, or Russia?"

The responses usually trickle off from there, but some of the time the lightbulb moment occurs, "oh yeah, there will always be a biggest military spender... there will always be a reserve currency...,_____ will be the industry leader..."

Most importantly- those things won't wait for you to decide which is the most moral/infallible possible version. Those at the top of industry, government, and emergent technologies know that if they hesitate -for even understandable reasons-

the next one will do it

Perhaps the biggest cause of this system is the reality of living in a world with long term (multi-generational) cause/effects, but ultimately governed by short and intermediate term interests.

"Why can't we just govern/vote/plan based on long term interests?"

All metrics/incentives are based on short term results:

-House/Senate/even executive re election on 4 year cycles- any promise longer than that scope MUST take a back seat to reelection efforts, otherwise any longer term goal by definition won't happen.

-CEO compensation based on quarterly numbers- industry leaders MUST plug leaking holes, even when they create a larger problem down the road. If they don't, they will be replaced by someone with an immediate leak plugging plan, even if it is inferior in the long term- the next one will do it

-Smaller industry goals based on who can be 1st to market, deliver fastest and cheapest (737 programmers)

If you are presenting a long term goal/plan in any industry, you must present a better cost/timetable than someone presenting a "do it now" approach, and if you or they don't, - the next one will do it

1.US Politics

Trump-

Policy-wise, Trump really hasn't been that far outside of the ordinary as he has sprinted back to the center from his campaign positions, so the biggest "next one will do it" component of his position is the branding/marketing. Since 2016 as I've said before, the heavy duty twitter/social media campaigning he has done has locked in trajectory for US and world politics (of both parties), where now if you aren't tweeting a response to every single issue/event, then you are left behind by an opposition who is. (of the same or opposite party) Furthermore, you will be left behind by algo/data in search/ news feeds, etc, and every campaign manager/party knows this, meaning both parties are locked into twitter spamming, even if they realize it will hurt their long term brand. There won't be a long term for them if they don't twitter spam and blast visibility in the short term.

Democrats-

The oversimplification of Bernie et al. offering free stuff in exchange for votes misses out on the trajectory we are looking at. They might be aware (or not, who knows) that if they aren't the one campaigning for everything free, basic income, etc, then the next one will do it.

They might intuitively understand that they are facing a race to the bottom, so there really is no alternative for their platform as long as they are being corralled into the unanimous hand raising positions. Given that internal competition and trajectory of their party platform, there is no short or intermediate term incentive to not campaign on free stuff, no matter how ineffective it is for them long term.

2.World Politics

Greek Austerity-

There is probably an example of this in every Eurozone country but the Tsipras / Varoufakis saga was so eye-opening a few years ago, and even though Varoufakis is an all in liberal, I still point to several of his quotes on crypto, etc. When Tsipras was faced with austerity measures to sign for further IMF funding, Varoufakis ultimately resigned/was fired for going against the grain saying "this is mathematically impossible" to repay/ work out. The short term incentive of immediate funding takes precedence over the long term reality that "running a country this way is mathematically impossible." Like clockwork, he was replaced with a "the next one will do it" yes man who went along with a repayment plan to further destroy Greece.

3.US Markets

Fed-

This comes back to the original "biggest military" question. A similar type of person will want to audit/end/abolish the fed!

"what do you want to replace it with?" uhh .. gold? BTC?

Ok, so which country do you want with a central bank controlling the world reserve currency, because they will not all simultaneously agree on gold/BTC- if you end the Fed, the next one will do it.

So do you want a Chinese/Russian Fed? The ECB/IMF negative rate show? Those are the "next ones" ...

TSLAQ-

This is mostly an aside/ highlight of the 'industry leader..' intro, but Elon is a pretty clear example currently and will definitely be in hindsight of literally saying anything to make it from investor call to earnings to call , etc. In back to back reports he has off the cuff changed the scope of the company from cars to insurance to robotaxis, where a different executive would just stick with their current sinking ship. He intuitively understands the value of wildly overpromising to keep momentum, otherwise some competition with less to lose would. He is "the next one will do it" in comparison to established auto makers who want to test safety and AI longer, and he is rewarded with temporary stock rips. We shouldn't blame him either, because if he didn't, the company would be dead- He has literally one path so in a game theory sense he is playing correctly.

4.World Markets

There is a lot of overlap between world 'politics' and 'markets' but one current bulletpoint is the trade war production 'shift' from China to surrounding countries.

The main consensus is that most production is still happening/shipping from China but the shipping is being faked from Vietnam/ others to circumvent tariffs. The main point from the Chinese perspective is that some companies will take on the risk of faking shipping because there is a risk premium there, and if you don't, you risk losing your business to the next one who will do it. If there is an exploitable corner of a market, ultimately someone will try to squeeze out the last drop of risk premium, and as long as that competition exists, it will force more to compete with that risk/pricing.

There are about another 80 bulletpoints you could put in each of these sections, but at least as a dusting overview I needed to yell on this, it feels completely under reported/discussed the the macro cause/effect politics/market universe we are in.

Seemingly bad/self destructive decisions are unavoidable because short term incentives can always be marketed by your competition.

Friday, May 31, 2019

PredictIt/ politics short VIX trades follow up

We do have some actual equity/bond movement this month so in addition to the long duration short VIX + ~1mo duration short puts on VIX and long TLT, I did want to give a PredictIt macro update-

Again I genuinely feel this was mispriced back at 80c, and have been able to average down to about ~74c. I do foresee it holding in this range and not 'vol crushing' immediately as the Dem/left platform is pretty locked in on 'impeachment' as a talking point. (note it repeated at every town hall event and twitter post after the Mueller conference- by every main Dem except Pelosi/Schumer) This has the echo effect of now not repeating the impeachment line/ position is not a Dem option given that so many are already on that side. (if you recall the black lives matter vs all lives matter part of the 2016 Dem primary debates)

Ultimately this cooks in a higher permanent risk premium for the rest of the year, as I posted earlier on twitter showing keeping the pricing flat for a month pops the annualized ROC by a couple percent. So overall, an even better entry now, and a 'grin and bear it' hold if you are in.

-Hillary

-Huma

-Don Jr

-Kushner

All slowly creeping up from the 84->88 range on average.

The higher risk tranche would be:

-Comey

-McCabe

-Brennan (coming soon according to PredictIt twitter)

Again I would strategically want to max that first group before Comey and friends, in the same way you want govt/investment grade before junk bonds, assuming all are mispriced and you don't strictly need to reach for yield.

Send me your thoughts on twitter!

The 1st recap and most important- the Trump 2019 impeachment market-

The Barr/Mueller statements appear to have added a good amount of volatility to this market, ultimately what we want as short VIX traders- to fade it. As of writing this and within the last week the Trump "no" impeachment trade went from ~80c to ~70c which is quite a move, but seems to be holding at the ~70c area as a 'support' in a technical sense. Again I genuinely feel this was mispriced back at 80c, and have been able to average down to about ~74c. I do foresee it holding in this range and not 'vol crushing' immediately as the Dem/left platform is pretty locked in on 'impeachment' as a talking point. (note it repeated at every town hall event and twitter post after the Mueller conference- by every main Dem except Pelosi/Schumer) This has the echo effect of now not repeating the impeachment line/ position is not a Dem option given that so many are already on that side. (if you recall the black lives matter vs all lives matter part of the 2016 Dem primary debates)

Ultimately this cooks in a higher permanent risk premium for the rest of the year, as I posted earlier on twitter showing keeping the pricing flat for a month pops the annualized ROC by a couple percent. So overall, an even better entry now, and a 'grin and bear it' hold if you are in.

2.- The other 'short VIX' Justice dept markets-

The rest of the 'indictment, charges, etc by 2019' markets are acting much closer to the short VIX time decay model I mentioned last month, the main ones being:-Hillary

-Huma

-Don Jr

-Kushner

All slowly creeping up from the 84->88 range on average.

The higher risk tranche would be:

-Comey

-McCabe

-Brennan (coming soon according to PredictIt twitter)

Again I would strategically want to max that first group before Comey and friends, in the same way you want govt/investment grade before junk bonds, assuming all are mispriced and you don't strictly need to reach for yield.

Send me your thoughts on twitter!

Thursday, May 2, 2019

Taking the plunge: a 'new' "short VIX" Market

I finally did it, took the plunge and signed up on PredictIt

On the EV front nothing has improved, PredictIt still has a 5% rake on wins based on your cost basis and a 5% rake on withdrawal, making it an effective Hotel California, but ultimately it is the only way to get exposure to non equity 'short VIX' markets which I've been blogging about for 2 years: the conceptual 'real life' volatility of events and fading unexpected outcomes.

Delving in: How is trading politics a short VIX trade?

I actually don't see this as a partisan/political trade at all, rather getting exposure to the mechanics of government regardless who is in the House/Senate/executive. (and possibly international election markets as well, but I think those are more correctly priced)

Lets take one of the most traded (on volume) bets on the board:

As of posting this the line is at 21c yes/ 79c no (forgive the screenshot timing mismatch) meaning being long the "no" at an avg. price of 79c would be worth $1 at "expiration" on Dec 31 2019, a (21/79)~ 26.5% ROI (before the death rake) in ~7 months, which is ~42% annualized.

Already I've inserted the phrase "expiration" so I've somewhat played my hand, but if you don't see where I'm going with this:

We are looking at essentially a short premium/ theta decay trade where there is a 21c option premium burning from now until Dec 31. (logically with 1 month or 1 day til expiration, the trade should be at 99c no/ 1c yes, as you can see several other 1 DTE political/election trades appear on the site)

The crux of the issue however: Why is this an obvious no? (a winning long 'yes' at 21c is 927% AROC)

Well, #1 if you care about option markets/sports betting, the overall direction is that it is a no given the spot price- the issue is how correctly priced it is, how much theta we are looking at ,etc.

(#1.1- why is this different from Trump having 1% chance to win the night before the election? - those were polls, not prediction markets/ skin in the game)

#2 lets look at the historical trends of 2/45 POTUS getting impeached, if you are in the 'spherical vacuum' of picking colored marbles out of a bag, that is a 4% which is closer to what I would assume this market should be priced at.

#3 the real meat of the assumption- the layers of government/bureaucracy/politicization we are looking at that create a 'status quo' buffer. Politics broadly is about little victories and compromises, meaning set the goal post of impeachment, then shift that to

-better mid term election numbers

-more twitter followers

-more campaign contributions

Which become a somewhat measurable 'smaller victory' and shift away from the red tape nightmare and optics of losing a majority vote on impeachment.

#3.1 the counterplay of IG Horowitz/FISA 'legal action' etc coming the other way, politically it might make sense to have an effective truce effectively adding to that status quo buffer.

A few more points on this trade specifically:

-Compare this to "Will Trump be impeached in his first term?"

Which has spot 'no' at 72c for a Jan 20 , 2021 expiration (21% AROC- literally half the 2019 trade for an almost identical market direction/assumption)

-Compare to 'trump GOP candidate', 'trump 2020 winner', which have him at 2x the next place. If that is where the line on those markets are, then a >20% chance of impeachment vote seems fundamentally mispriced as a reflection of the incentives of the house and senate to conform to their constituent status quo.

-Compare to world election markets currently up: Netanyahu indicted, Nigerian pres re election, pope vacancy- All with lines in the <10c range which seem much more correctly priced given that you are trading a massive upset. Compare that to the .90 delta equity options when get hit all the time!

Now looking toward other/broader PredictIt trades

The trump 12/31 impeachment is just one example with some pretty clear numbers, but is by no means the end of the short VIX/ theta decay I'm looking at.

Some others that come to mind:

Both have a very similar short VIX structure to the Trump impeachment trade, despite them being polar opposites politically- which is why I prefaced these trades as non political. We are looking at fading a historically unlikely and status quo buffered move, with a defined duration / AROC. The Trump version of it is just a little more juiced, but I'll probably add on positions in all of them.

Lets look at some cons:

So we have gone over this as a semi uncorrelated market to equities with some actual ROI numbers, fairly tight markets (better than many equity options) and most importantly a small enough total market to not get insta zapped by big bank algos(thus the mispricing) but obviously it took me a while to bite the bullet because of some big problems:

-Insane, unbeatable rake: 5% on profits and 5% on withdrawal. That is some live poker, 2/20 fund manager level of unbeatable, so you basically need trades like the trump 42% AROC to even think twice.

-Inconsistent markets- as we are entering election season we have a lot of new trades coming up, and specifically under trump with the nonstop legal backdrop on the whole presidency, we probably won't have this kind of impeachment risk premium going forward. This ties into the "AROC" issue, as these 'impeachment/ by end of term' trades are 1 time, and thus bad for an AROC model like compounding dividends or rolling option premium monthly. Unfortunately we need some way to quantify things, so we have a trade, risk ,and duration, so there you are.

-Counterparty risk- here is a big one, PredictIt is pretty much the only one in this space, with a few sports betting sites touching US election/primaries, but nothing with the depth of the justice department investigations, world politics. We are already looking at withdrawal 30 day type issues and who knows what kind of regulatory/ liquidity issues could spawn.

-Size - lets call this .5 because due to the above counterparty risk, you should probably stay small anyway, but there is a total position size cap, which is good in some cases as it keeps big fish out and keeps potential mispricing.

-All or non trade- Yes this is basically just sports betting, where you win or lose all at expiration, you can't sell a call against your position/ flatten your deltas, / lower your cost basis, so ultimately I think of it like a vertical spread where at entry you are looking at a max premium win or max loss, take it, and move on to the next trade. This ties into sizing above, as sizing/ risk management is half of vertical spread/ leverage trading.

Lets start here for now, I've got a lot more to add in terms of discussing the current trades, upcoming trades as they are added to the site , as well as such prediction markets being a big part of my future vision of markets.

Stay tuned!

Friday, April 5, 2019

The QUIET New Deal

"Wherever I am, there is also... a leafblower"

I have a proposal for all Green New Deal liberals - without even immediately discounting the 'no planes' / full remove fossil fuels , $100T annual global policy change. As a self identified 'conservative' MMTer , I can't go to the well of 'that spending isn't feasible, how will you pay for it!' etc

I just have one preface and THEN we can go there.

If you are a liberal/green new deal politician or supporter, I want ALL LEAFBLOWERS gone from your district before you even start going off on how will manage changing the fossil fuel global economy. Some even have gas in them, so it should be step 1 on your crusade anyway. What is greener than having leaves everywhere and no deafening power consumption 24/7?

As someone living in the liberal ground zero epicenter Fukushima/Chernobyl Los Angeles, the Green New Deal probably has the most support here and yet we still have 12hrs of leafblowers per block everyday.

If you are debating with a green new deal liberal and they won't interact on the budget/fiscal policy/incentives etc axis, simply shift the Overton Window to "I agree with you, why can't we solve this tiny subsection of your problem 1st, to prove you are right?" I'm trying to help you out!

I'm waiting for the day we can finally meet a liberal legislator/ governor and say "wow, you've gotten leafblowers and noise pollution out of your district, dealt with the fiscal and social policy/ incentive scope of that. Great, now you can present the full logic for your global green new deal"

As usual I expect zero rebuttals or even responses.

Also VIX down of course.

I have a proposal for all Green New Deal liberals - without even immediately discounting the 'no planes' / full remove fossil fuels , $100T annual global policy change. As a self identified 'conservative' MMTer , I can't go to the well of 'that spending isn't feasible, how will you pay for it!' etc

I just have one preface and THEN we can go there.

NO LEAFBLOWERS.

If you are a liberal/green new deal politician or supporter, I want ALL LEAFBLOWERS gone from your district before you even start going off on how will manage changing the fossil fuel global economy. Some even have gas in them, so it should be step 1 on your crusade anyway. What is greener than having leaves everywhere and no deafening power consumption 24/7?

As someone living in the liberal ground zero epicenter Fukushima/Chernobyl Los Angeles, the Green New Deal probably has the most support here and yet we still have 12hrs of leafblowers per block everyday.

This is my #QUIETNEWDEAL

I'm waiting for the day we can finally meet a liberal legislator/ governor and say "wow, you've gotten leafblowers and noise pollution out of your district, dealt with the fiscal and social policy/ incentive scope of that. Great, now you can present the full logic for your global green new deal"

As usual I expect zero rebuttals or even responses.

Also VIX down of course.

Wednesday, March 13, 2019

The 2018 short VIX Odyssey

As usual I try to avoid "trade journaling" but this felt like a broader 'proof of concept' from the last few months-

If you can remember back to the far left here, just before the 2018 3 month sell off AKA the "December Glitch" I was selling call spreads at the 40 short strike with ~6month duration.

If you can remember back to the far left here, just before the 2018 3 month sell off AKA the "December Glitch" I was selling call spreads at the 40 short strike with ~6month duration.

As if in a cartoon, UVXY almost instantly 2-3x'd against me, thus began my 10 year Trojan war...

Since September, I added on more to the short position and sold puts/ put spreads against it to flatten deltas, some getting back off for a scratch, some a small loss (note the huge drops back in 2019)

Ultimately that brings us back to this week, almost exactly at expiration with UVXY returning home to Penelope at 39.xx ...

Since I'm not a pure fentanyl rush gambler, I've been slowly taking off some of the short call lots for a scratch or small loss as we approach expiration , while flattening deltas with short puts, basically reducing crash/spike risk as we almost return home. (Its more thematic to fight the cyclops in the middle of the journey than to get bludgeoned right back at your doorstep)

So basically we have a 6 month scratch trade, this isn't what you point back at to clarify genius... this isn't going 100x leverage on your student loans to buy penny stocks/crypto and 20x, so who cares?

The point is the inevitability of the short VIX complex mechanically, and even a very bad trade can be managed/ flattened, but ultimately saved with duration at the beginning.

I'll wait for another vol pop to re add long duration positions (we've been vol crushing for a week now), but to eyeball a trade with UVXY spot at ~40, the 1yr 40/45 call spread looks about 33% ROIC, which should be very good for a conservative annual trade.

If you can remember back to the far left here, just before the 2018 3 month sell off AKA the "December Glitch" I was selling call spreads at the 40 short strike with ~6month duration.

If you can remember back to the far left here, just before the 2018 3 month sell off AKA the "December Glitch" I was selling call spreads at the 40 short strike with ~6month duration. As if in a cartoon, UVXY almost instantly 2-3x'd against me, thus began my 10 year Trojan war...

Since September, I added on more to the short position and sold puts/ put spreads against it to flatten deltas, some getting back off for a scratch, some a small loss (note the huge drops back in 2019)

Ultimately that brings us back to this week, almost exactly at expiration with UVXY returning home to Penelope at 39.xx ...

Since I'm not a pure fentanyl rush gambler, I've been slowly taking off some of the short call lots for a scratch or small loss as we approach expiration , while flattening deltas with short puts, basically reducing crash/spike risk as we almost return home. (Its more thematic to fight the cyclops in the middle of the journey than to get bludgeoned right back at your doorstep)

So basically we have a 6 month scratch trade, this isn't what you point back at to clarify genius... this isn't going 100x leverage on your student loans to buy penny stocks/crypto and 20x, so who cares?

The point is the inevitability of the short VIX complex mechanically, and even a very bad trade can be managed/ flattened, but ultimately saved with duration at the beginning.

Takeaways/ Going forward- 1yr duration

In hindsight I was happy I stayed more conservative with the 6mo trade into those Oct/Dec spikes, while some of the short vol crowd were putting on the 'traditional' ~45 day premium trade. I did a lot of backtesting in the last year before the UVXY leverage rebalance, and was looking at the 6mo to 1yr duration, and especially now with the deleverage I would lean to the longer duration to offset the weaker decay.I'll wait for another vol pop to re add long duration positions (we've been vol crushing for a week now), but to eyeball a trade with UVXY spot at ~40, the 1yr 40/45 call spread looks about 33% ROIC, which should be very good for a conservative annual trade.

Subscribe to:

Posts (Atom)